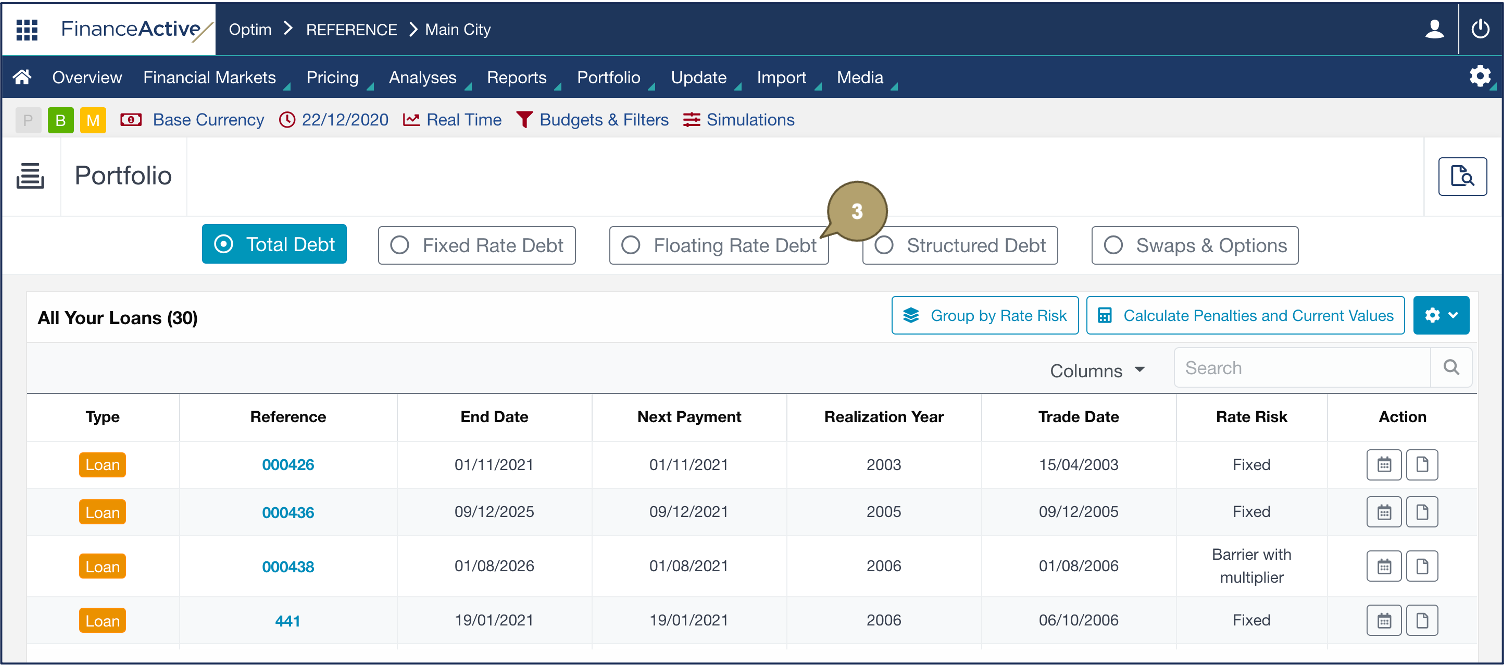

The framework and validation of the database are important stages in our relationship. They optimize your use of Fairways Debt:

- Accurate reporting and debt audits

- Trustworthy debt statements

- Relevant recommendations from your consultant

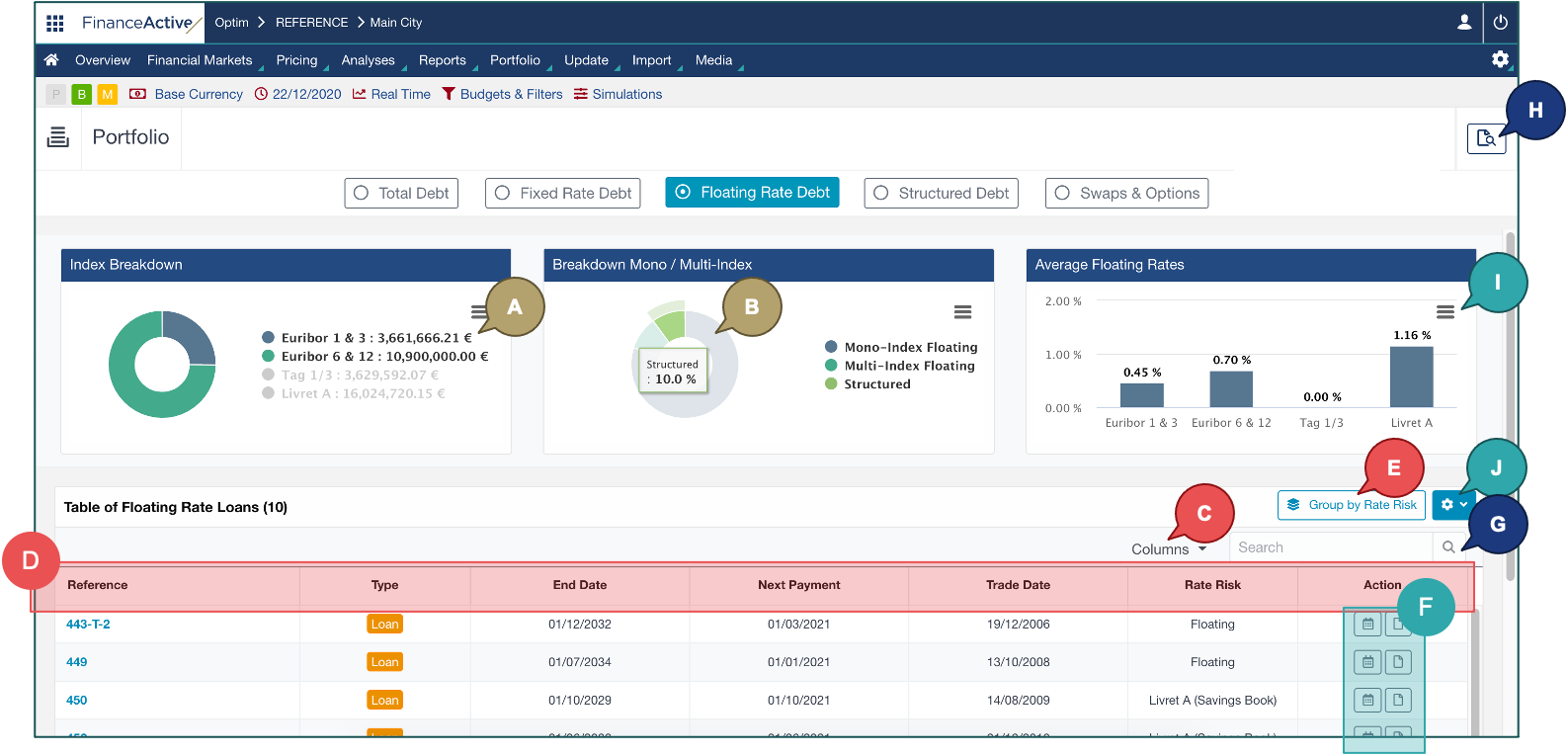

The Floating Rate Debt page gives you an overview of your transactions with floating rates.

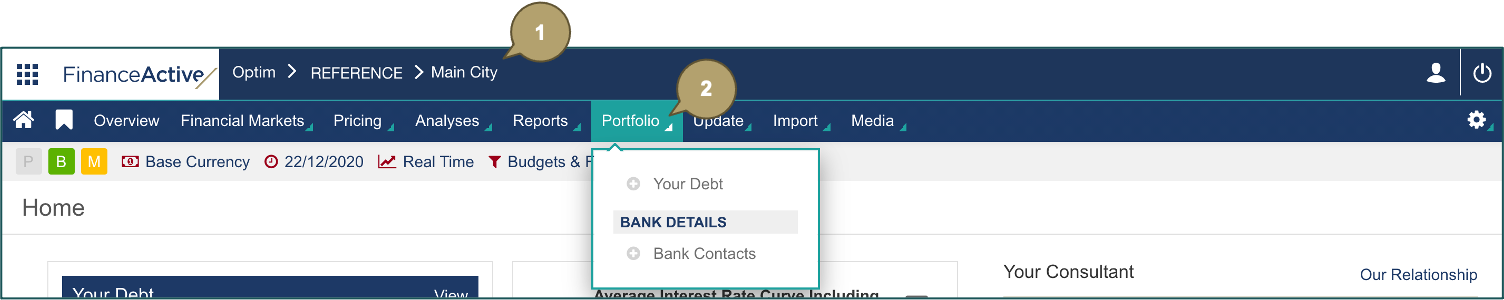

- Log in to Fairways Debt, and load the customer account, if relevant.

- Navigate to Portfolio > Your Debt.

- Click Floating Rate Debt.

Note: The tab only displays if your portfolio includes at least a transaction associated with a floating rate.

The Floating Rate Debt page displays.

|

# |

Description |

|---|---|

|

A |

Click a criterion to filter the graph data:

|

|

B |

Hover over a data to display its details. |

|

C |

Select the data to display. |

| D |

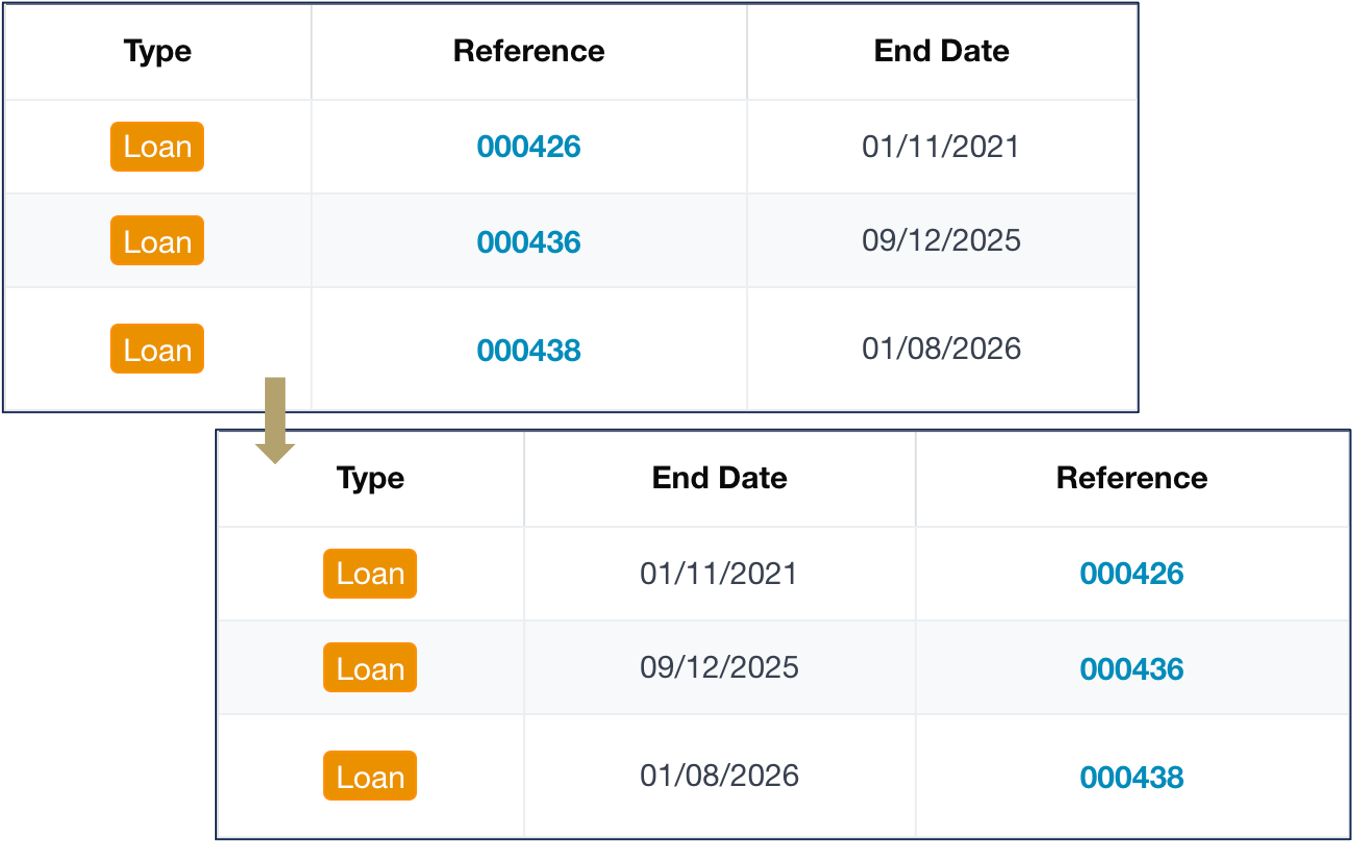

Order data:

In this example, we order End Date before Reference.

|

|

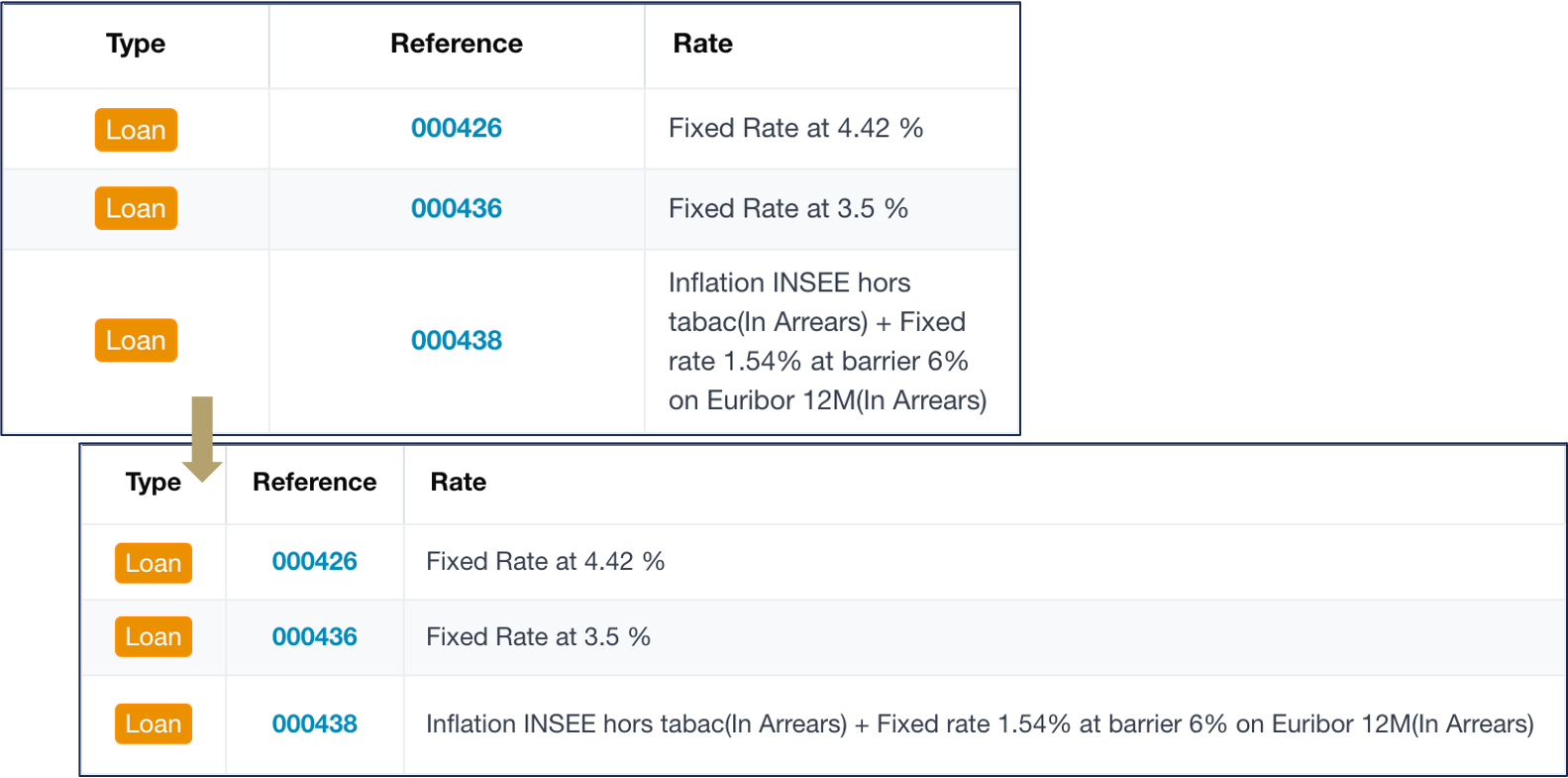

Resize the column width:

In this example, we reduce the Type and Reference columns and enlarge the Rate column.

|

|

|

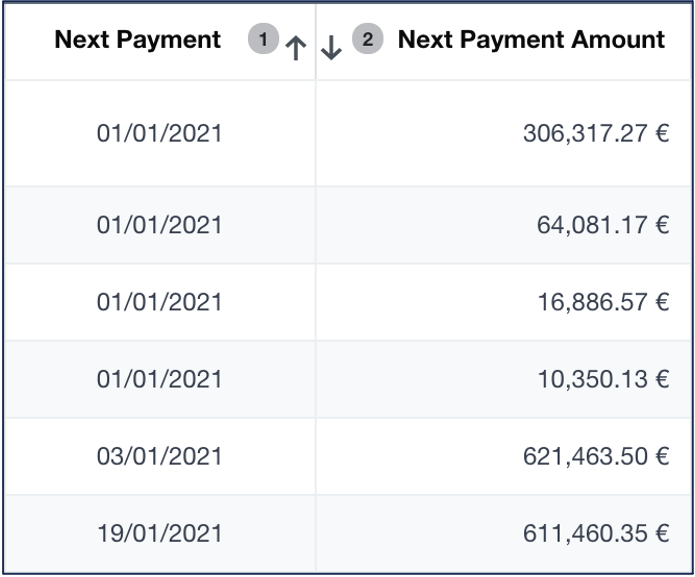

Click a header to sort the transactions following a specific criterion. To sort using multiple criteria:

In this example, the data is sorted by the next payment date in the ascending order, then by the amount in the descending order.

|

|

| E |

Group the transactions by rate risk. |

| F |

Open the transaction details. Note: Clicking the type and the reference also enables you to open the transaction profiles. |

| G |

Search for a transaction within the list. |

| H |

Search for a transaction within the whole portfolio. |

| I |

Download the graphs. |

| J |

Download the table to Excel. |