You can simulate loans in Fairways Debt.

Log In to Fairways Debt

- Log in to Fairways Debt.

- Load the relevant customer account.

Simulate a Loan

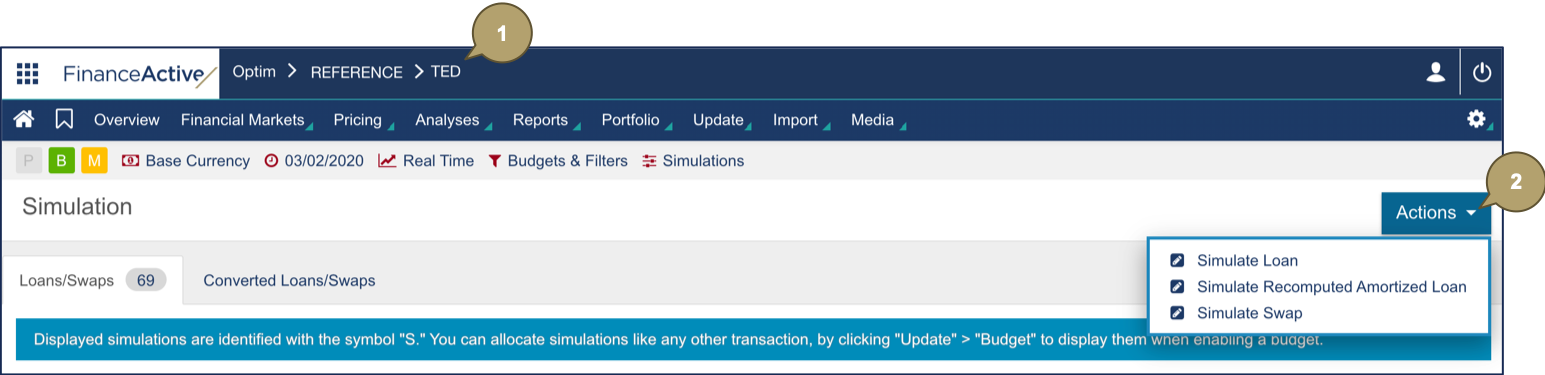

- Navigate to Simulations.

- Click Actions > Simulate Loan.

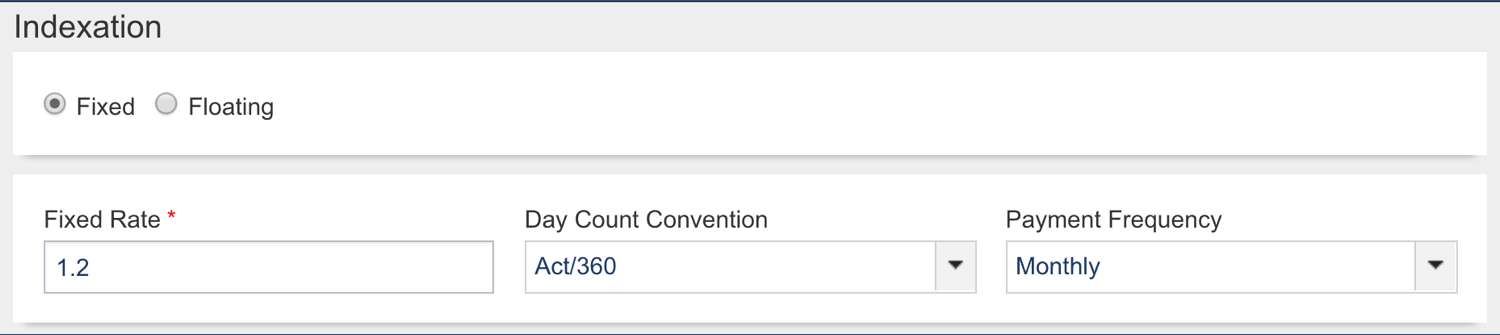

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

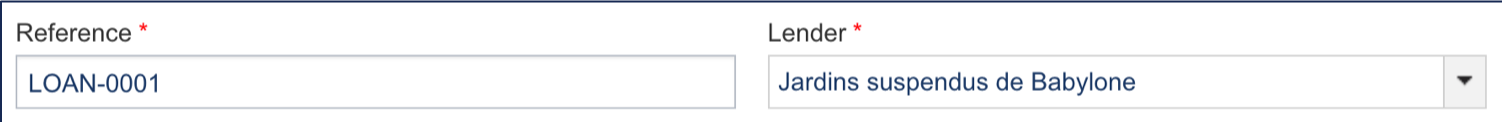

Reference |

Name of the loan. |

|

Lender |

Loan's lender. Note: Only banks associated with actual loans added to Fairways Debt display. |

|

Field |

Description |

|---|---|

|

Amount |

Amount and currency of the loan. |

|

Start Date |

Start date of the loan. |

|

Trade Date |

Date at which the loan has been traded. |

|

Term to Maturity |

Duration of the loan. |

|

Amortization Mode |

Amortization mode of the loan. Note: Additional fields to complete display depending on the mode selected. |

|

Frequency |

Note: This field only applies to amortization modes:

Amortization frequency. |

|

Growth Rate |

Note: This field only applies to the progressive amortization mode. Growth rate of the amortization. |

|

Field |

Description |

|---|---|

|

Indexation Type |

Computation type of rate. Note: Additional fields display depending on the type selected. |

|

Fixed Rate |

|

|

Fixed Rate (%) |

Fixed rate in percentage. |

|

Day Count Convention |

Computation of the day fraction of an interest accrual period. |

|

Payment Frequency |

Payment frequency. |

|

Floating Rate |

|

|

Currency |

Currency of the rate. |

|

Rate |

Index of the rate. |

|

Margin |

Margin in percentage. |

|

FloorType |

Floor type of the rate. Note: Additional fields display depending on the type selected. |

|

Level |

Note: This field only applies to the On Level Index + Spread floor type. Index level of the floor type on level. |

|

Day Count Convention |

Computation of the day fraction of an interest accrual period. |

|

Fixing Frequency |

Fixing frequency. |

|

Fixing Reference |

Fixing type. |

|

Day Adjustment |

Adjustment following the business day convention. |

|

Adjustment mode for the interest calculation. |

|

|

Rounding |

Count of decimals. |

|

Rounding |

Rounding type. |

- Click Done to simulate the loan.

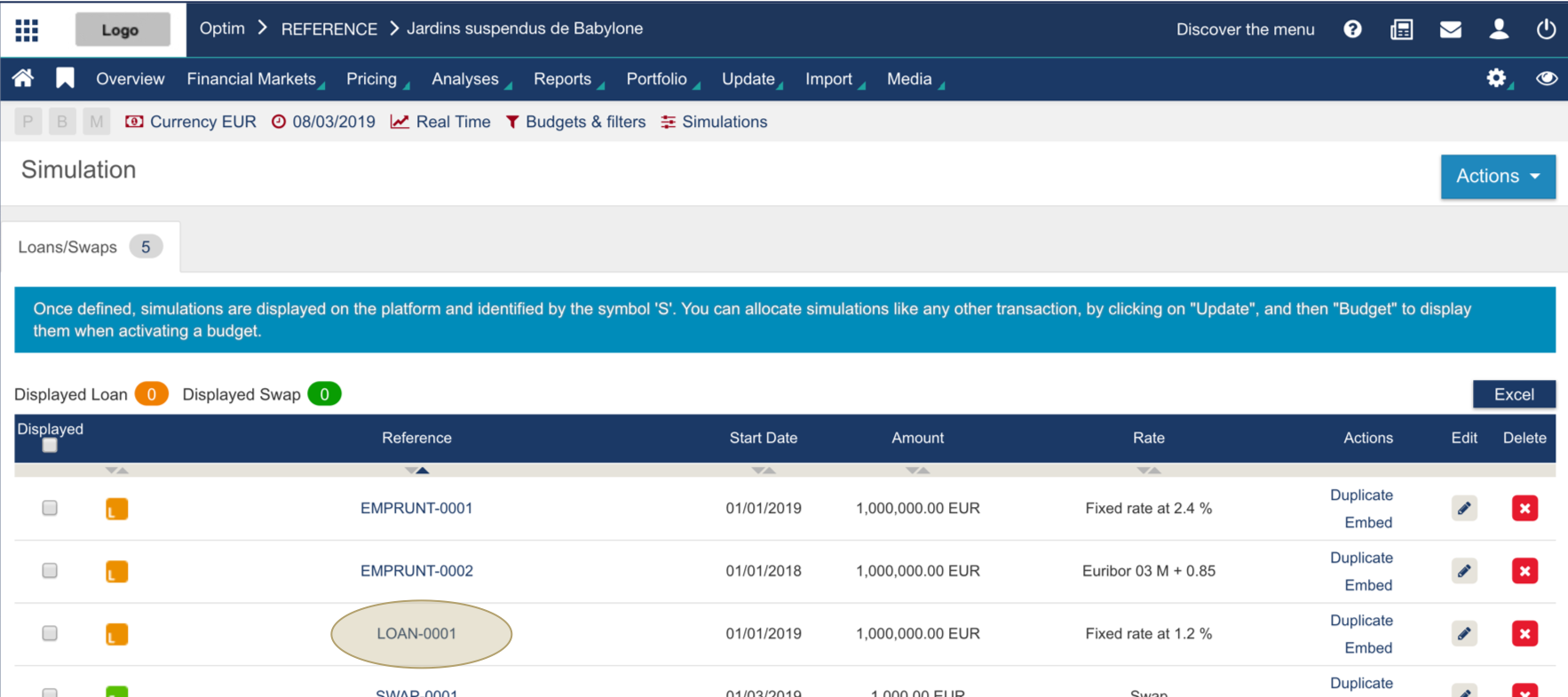

The loan simulation displays in the list.

Adjustment

Adjustment modes define how the system rolls dates in case of holidays in the calendar.

|

Field |

Description |

|---|---|

|

CAL - Calendars |

Not rolled, unless day adjustment defined. |

|

BD - Business Days |

Rolled to the previous/next business day depending on the day adjustment defined. |

|

PBD - Calendars (preceding) |

Rolled to the previous business day. |

|

NBD - Calendars (following) |

Rolled to the next business day. |

|

NBD-M - Calendars (modified following) |

Rolled to the next business day, only if that day occurs in the same month. Otherwise, rolled to the next/previous business day depending on the day adjustment defined. |