Fairways Debt offers you pricing tools, e.g. valuation of fixed rates. Fairways Debt compares a fixed rate with market data and then extracts its spread. Use this tool to evaluate the offers you receive.

Log In to Fairways Debt

- Log in to Fairways Debt.

- Load the relevant customer account.

Value a Classic Fixed Rate

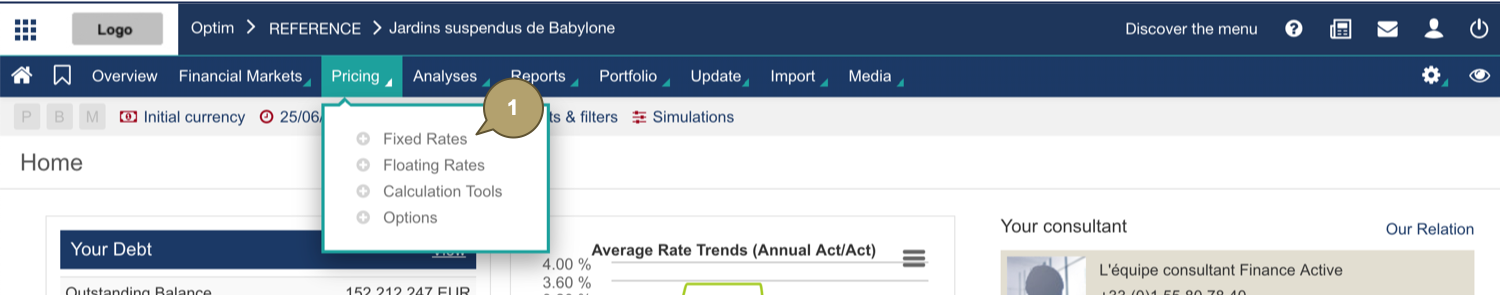

- Navigate to Pricing > Fixed Rates.

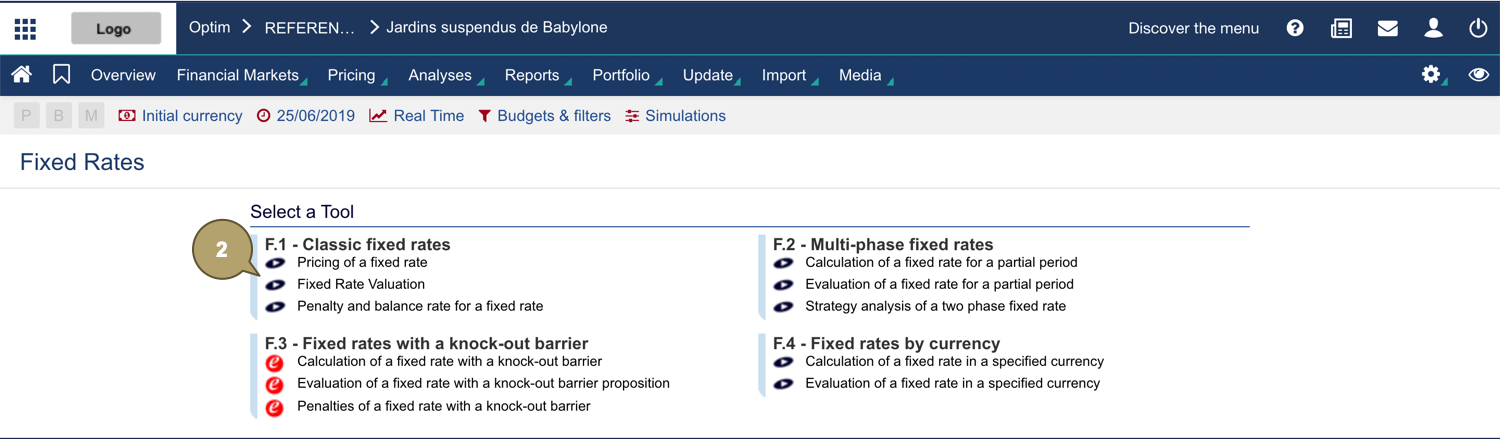

- In Classic Fixed rates, click Fixed Rate Valuation.

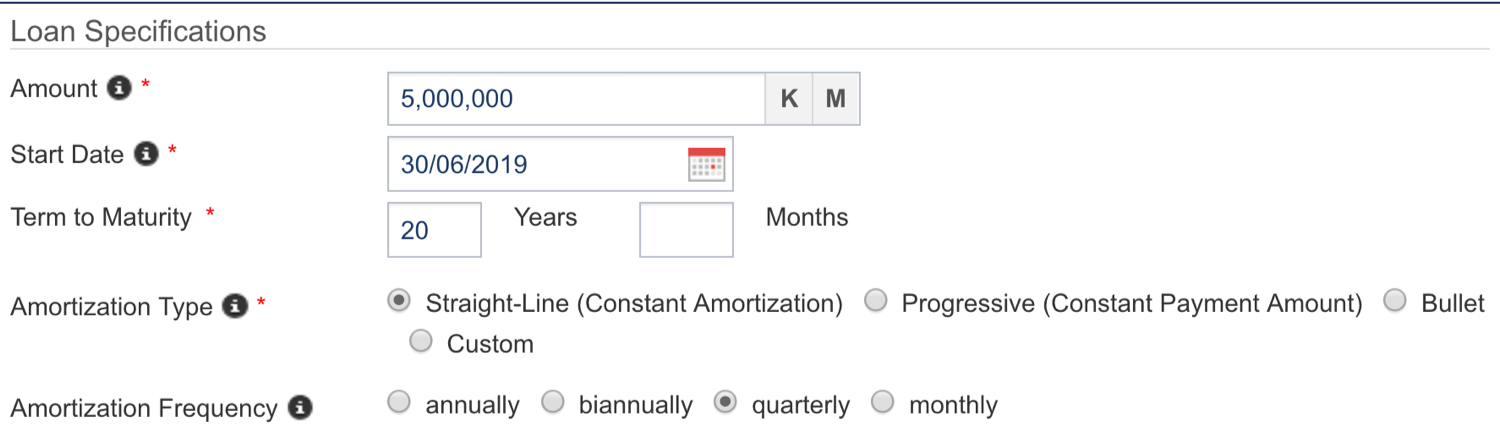

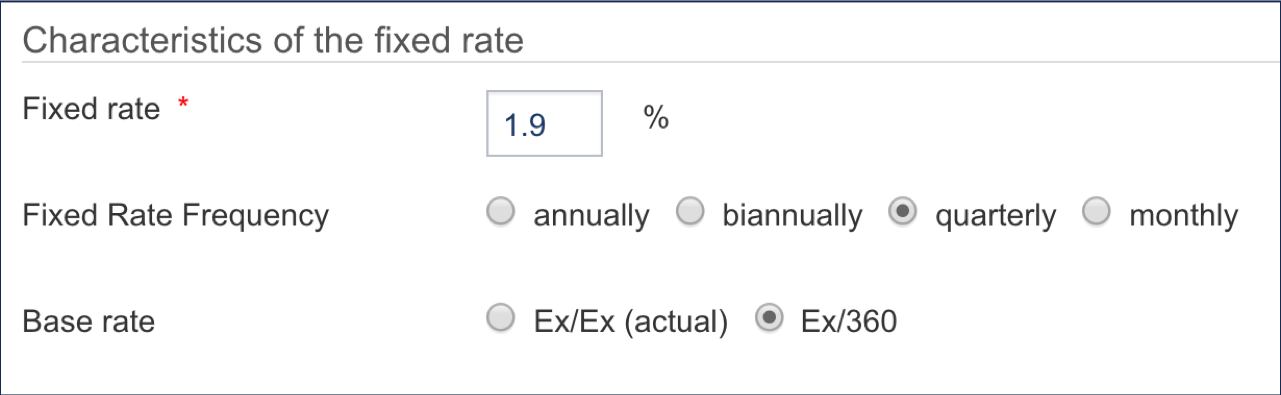

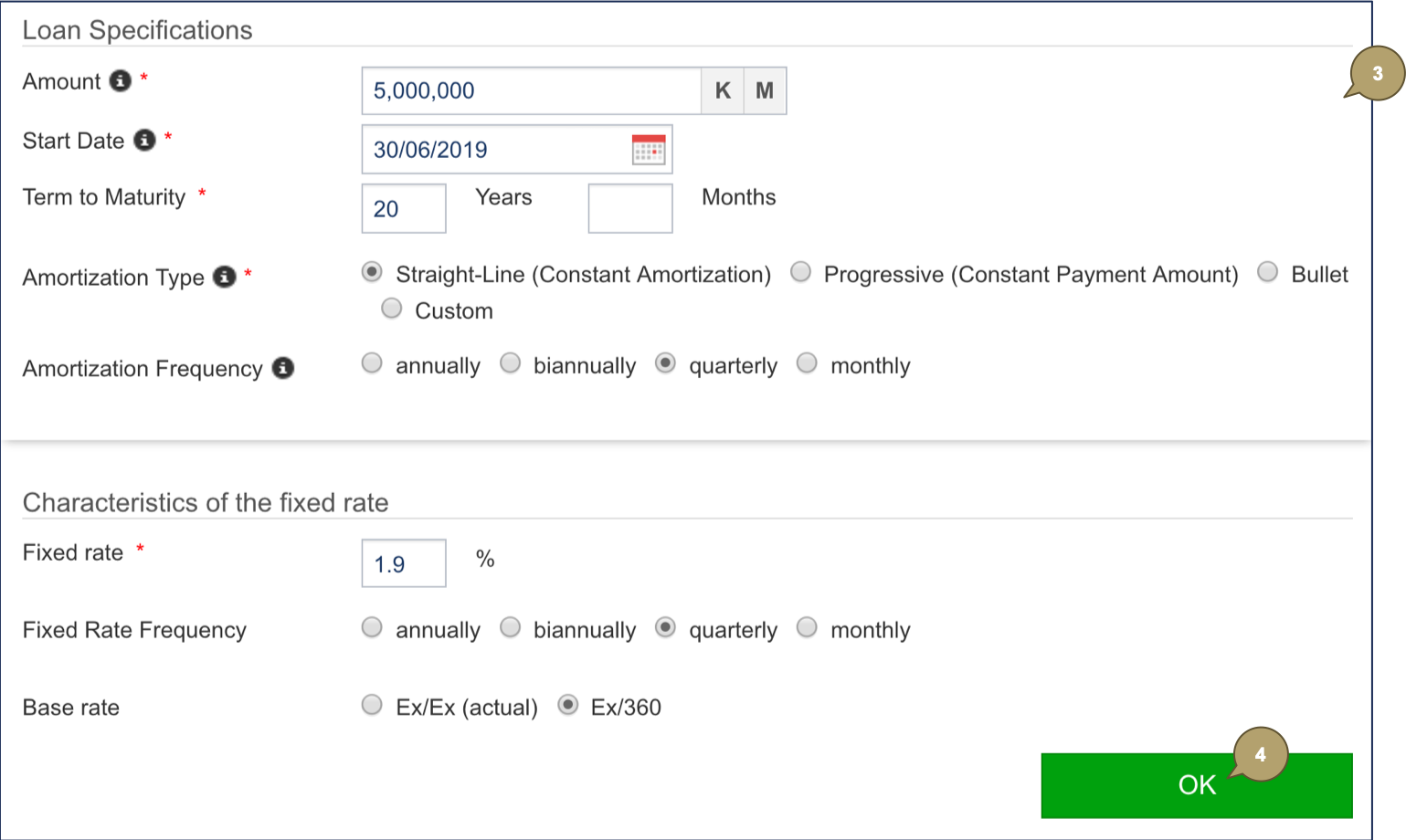

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Amount |

Amount borrowed. |

|

Start Date |

Initial start date of the loan. |

|

Term to Maturity |

Loan duration. |

|

Amortization Type |

Amortization mode. |

|

Amortization Frequency |

Amortization frequency. |

|

Field |

Description |

|---|---|

|

Fixed Rate |

Rate of the loan. |

|

Fixed Rate Frequency |

Frequency of the rate. |

|

Base Rate |

Basis for calculating interest. |

- Click OK to value the rate.

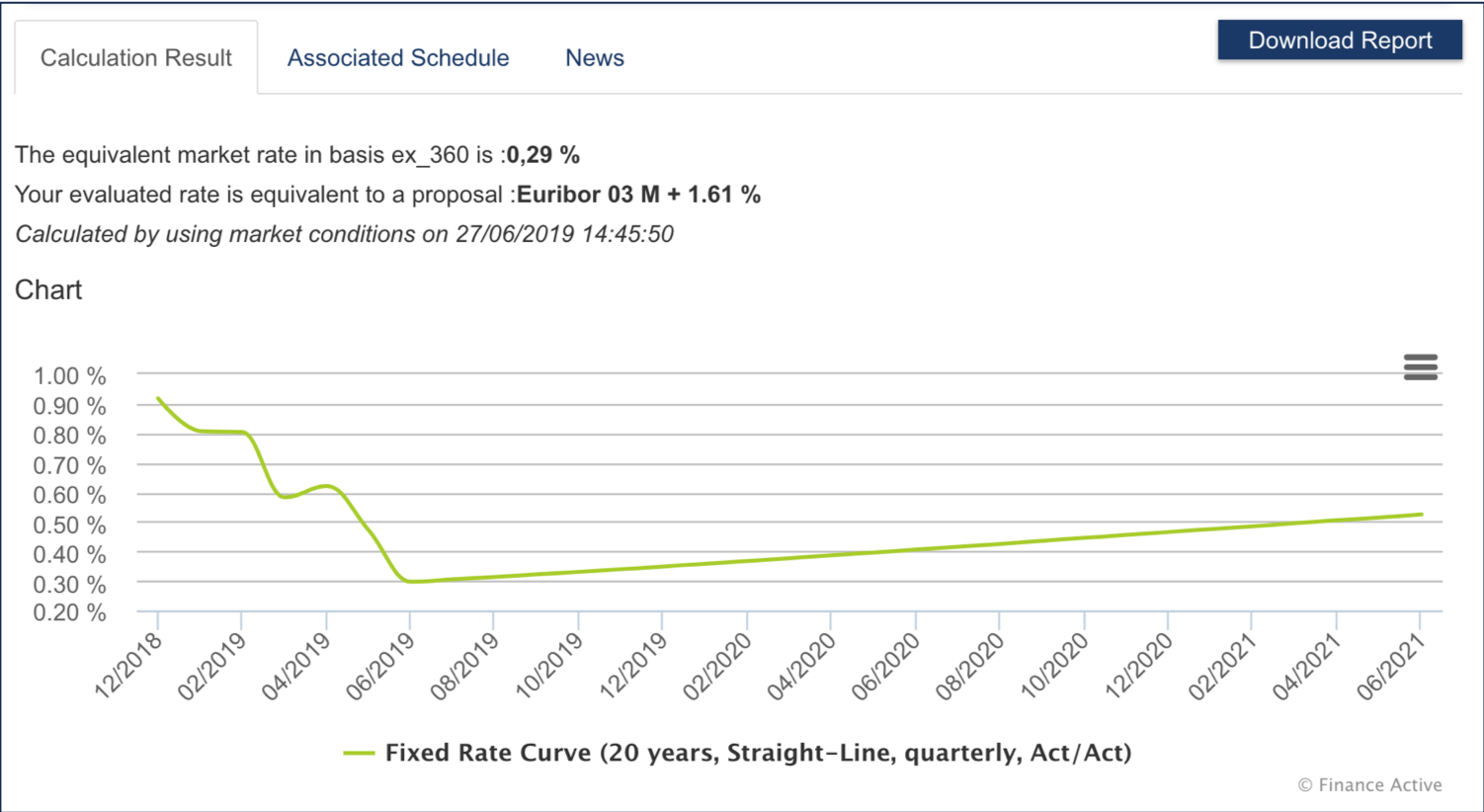

The valuation results display:

- The equivalent market rate is 0,29%.

- The spread is 1,61%.

You can then compare this spread to other bank offers' (at fixed and floating rates) as well as to average spreads available in Funding & Tenders.